Richard Demille Wyckoff (1873 – 1934) là một trong những người tiên phong từ những năm đầu thế kỷ 20 trong việc áp dụng phân tích kỹ thuật để nghiên cứu thị trường chứng khoán. Ông được coi là một trong năm người khổng lồ về phân tích kỹ thuật, cùng với Dow, Gann, Elliott và Merrill.

Richard Demille Wyckoff (1873 – 1934) là một trong những người tiên phong từ những năm đầu thế kỷ 20 trong việc áp dụng phân tích kỹ thuật để nghiên cứu thị trường chứng khoán. Ông được coi là một trong năm người khổng lồ về phân tích kỹ thuật, cùng với Dow, Gann, Elliott và Merrill.

Năm 1888, khi mới 15 tuổi, ông bắt đầu sự nghiệp với vị trí nhân viên nhập lệnh cho một công ty môi giới ở New York, sau đó Ông tự mở công ty môi giới riêng khi mới 25 tuổi. Ông cũng là nhà sáng lập, viết bài và biên tập viên của Tạp chí Phố Wall trong gần hai thập kỷ, mà từng có thời điểm có hơn 200.000 người đăng ký.

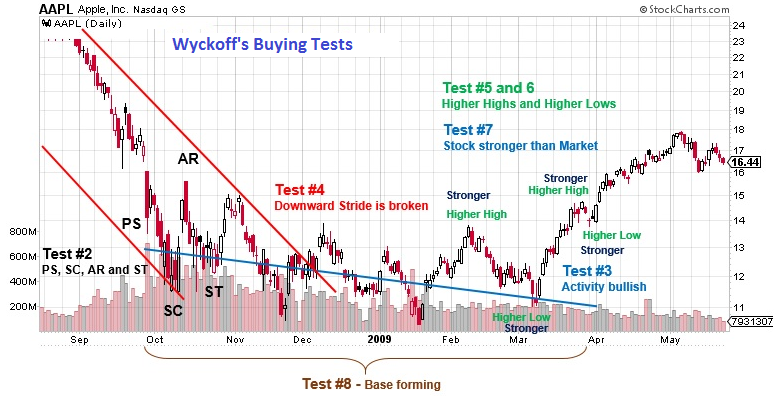

Wyckoff là một nhà nghiên cứu nhiệt thành của thị trường chứng khoán và là một người đọc và giao dịch bằng đồ thị. Ông quan sát các hoạt động thị trường và các chiến dịch của các nhà tạo lập huyền thoại trong thời đại của mình, bao gồm JP Morgan và Jesse Livermore. Từ những quan sát và phỏng vấn của mình với những nhà giao dịch lớn đó, Wyckoff đã hệ thống hóa các thực tiễn tốt nhất của họ thành quy luật, nguyên tắc và kỹ thuật giao dịch, quản lý tiền, cũng như tính kỷ luật.

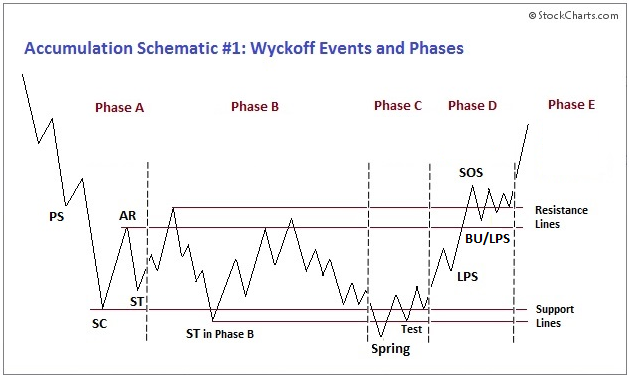

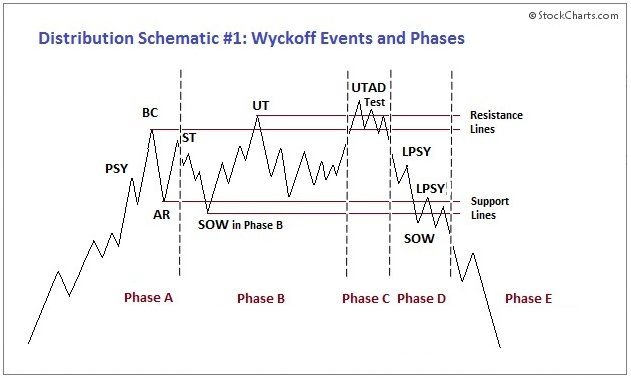

Wyckoff thấy các nhà đầu tư nhỏ lẻ liên tục thua lỗ và phải rời khỏi thị trường, và ông quyết định tận tình hướng dẫn họ về các quy tắc thực sự của trò chơi, được cầm trịch bởi những nhóm lợi ích lớn, hay dòng tiền thông minh, phía sau sân khấu. Vào những năm 1930, ông thành lập một Học viện đào tạo, sau này trở thành Học viện Wyckoff Mỹ. Trọng tâm là các khóa học tích hợp các khái niệm mà Wyckoff đã nghiên cứu về cách xác định các nhà đầu cơ lớn tích lũy và phân phối cổ phiếu, và làm thế nào để có được vị trí hài hòa với những người chơi lớn này. Sau khi Wyckoff mất năm 1934, khóa học được tiếp tục phát triển bởi những sinh viên hàng đầu của ông trong đó có Bob Evans, Hank Pruden.

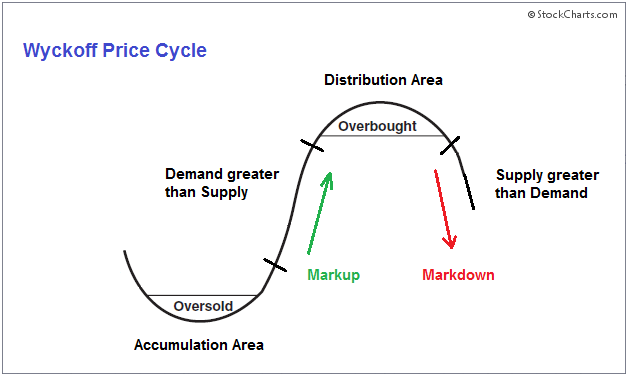

Nhiều nhà đầu tư chuyên nghiệp và các nhà đầu tư tổ chức tiếp tục áp dụng những hiểu biết và nguyên tắc được kiểm tra theo thời gian của Wyckoff, có giá trị đến ngày nay. Các cách tiếp cận lý thuyết và thực tế của Wyckoff đối với thị trường, bao gồm hướng dẫn xác định các cổ phiếu tiềm năng, để vào các lệnh mua hoặc bán, phân tích kênh giao động, tích lũy và phân phối, cách sử dụng biểu đồ Point and Figure để xác định mục tiêu giá cả.

Mặc dù phương pháp này nguyên gốc hoàn toàn tập trung vào cổ phiếu, nhưng phương pháp Wyckoff cũng có thể được áp dụng cho bất kỳ thị trường giao dịch tự do nào mà các nhà giao dịch tổ chức lớn hoạt động, bao gồm hàng hóa, trái phiếu và tiền tệ.